georgia estate tax rate 2020

The tax rate works out to be 3146 plus 37 of income over 13050. 2020 Georgia Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

2021 Property Tax Bills Sent Out Cobb County Georgia

The amount paid to Georgia is a direct credit against the federal estate tax.

. You would pay 95000 10 in inheritance taxes. Georgia law is similar to federal law. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million.

1536 Heritage Pass Milton GA 30004 in. In Fulton County the states. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

The tax rate schedule for estates and trusts in 2020 is as follows. Georgia has no inheritance tax. Georgia estate tax rate 2020.

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. Your 2021 Tax Bracket to See Whats Been Adjusted. Georgia estate tax rate 2020.

The rate remains 40 percent. 260 plus 24 percent of the excess over 2600. Counties in Georgia collect an average of 083 of a propertys assesed fair market value as property tax per year.

Over 9450 but not over 12950. 48-12-1 was added to read as follows. Then you take the 1158 million number and figure out what the estate tax on that.

Compare your take home after tax and. Net Investment Income Tax. Georgia is ranked number thirty three out of the fifty states in order of the average amount of property.

Over 2600 but not over 9450. For 2020 the estate tax exemption is set at 1158 million for individuals and 2316 million for married couples filing jointly. 2021 - 501 Fiduciary Income Tax Return 2020 - 501 Fiduciary Income Tax Return Prior Years - 2019 and earlier.

Does Georgia have an estate tax. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. July 07 2021.

083 of home value. Estate tax of 08 percent to 16 percent on estates above 4 million Iowa. The top Georgia tax rate has decreased from 575 to 55 while the tax brackets are unchanged from last year.

Georgia Estate Tax Rate 2020 More specifically georgia levies the following taxes. Nevertheless you may have to pay the estate tax levied by the federal government. In 2021 federal estate tax generally applies to assets over 117 million.

2790 cents per gallon of regular gasoline 3130 cents per gallon of diesel. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. In a county where the millage rate is 25 mills the property tax on that house would be 1000.

Estate tax of 112 percent to 16 percent on estates above 4 million Hawaii. 2020 Tax Tables 16693 KB Department of Revenue. Federal Tax Rates and Tax Brackets.

062520 FiduciaryIncomeTaxReturn 2020 Approved web version Page 1 Fiscal Year Beginning Nonresident Change in Trust or Estate Name Change in Fiduciary Change of Address Grantor Trust Trust is a Qualified Funeral Trust Estate is a Bankruptcy Estate 500 UET Exception Attached Fiscal Year Ending A. Inheritance tax of up to 15 percent. Estate tax of 108 percent to 12 percent on estates above 71 million District of Columbia.

Georgias estate tax is based on the amount allowable as a credit for state death taxes on the federal estate tax return Form 706. Discover Helpful Information and Resources on Taxes From AARP. Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes.

Historical tax rates are available. Property tax and gas rates for the state are also close to the. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021.

2 the top tax rate is 12. Due to the high limit many estates are exempt from estate taxes. Outlook for the 2021 Georgia income tax rate is for the top tax rate to decrease further or change to a.

Georgia Tax Center Help Individual Income Taxes Register New Business. The estate tax is a tax on a persons assets after death. Before assuming that an estate is exempt it is critically important to analyze the estate because many assets such as life.

31 2020 may be subject to an estate tax with an applicable exclusion amount of 11580000 increased from 114 million in 2019the top marginal rate remains 40. As of July 1 2014 Georgia does not have an estate tax either. Georgia income tax rate and tax brackets shown in the table below are based on income earned between January 1 2020 through December 31 2020.

Detailed Georgia state income tax rates and brackets are available on this page. Estate tax of 10 percent to 20 percent on estates above 55 million Illinois. Federal Employer ID No.

Georgia Form 501 Rev. Georgia Estate Tax Rate 2020. You would receive 950000.

The highest trust and estate tax rate is 37. Does Georgia have an estate tax. Tax amount varies by county.

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. Unclaimed Property X About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences Information and Records Requests. IRS Inflation Adjustments for Tax Year 2022.

2016 accrues at the rate of 12 percent annually. Download and save the form to your local computer. If taxable income is.

The Georgia County Ad Valorem Tax Digest Millage Rates have the actual millage rates for each taxing jurisdiction. It applies to income of 13050 or more for deaths that occurred in 2021. Also called a death tax the estate tax is the final round of taxes someone pays before their property is distributed to their heirs.

25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. Use the tax table in the federal instructions to compute the credit. To successfully complete the form you must download and use the current version of Adobe Acrobat Reader.

To save the file right-click and choose save link as. Overall georgia tax picture the state income tax rates in georgia ranges from 1 to 575. Property is taxed according to millage rates assessed by different government entities.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. By Busch Reed Jones Leeper PC. A On and after July 1 2014 there shall be no estate taxes levied by the state and no estate tax returns shall be.

Before the official 2021 georgia income tax rates are released provisional 2021 tax rates are based on georgias 2020 income tax brackets. Ad Compare Your 2022 Tax Bracket vs. The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023.

10 percent of taxable income. The estate would pay 50000 5 in estate taxes.

Taxes In Georgia Country Income Corporate Vat More

Tax Rates Gordon County Government

136 7th St Mount Airy Ga 30563 Mls 8590224 Zillow Mount Airy Zillow Foreclosures

Lower Property Tax Atlanta Ga Property Tax Firm Atlanta Property Tax Housing Market Tax Consulting

Georgia May Suspend Gas Tax To Fight Price Surge And These States Could Be Next

Georgia Estate Tax Everything You Need To Know Smartasset

1216 E 52nd St Savannah Ga 31404 Mls 201072 Zillow Savannah Houses Savannah Chat Zillow

Savannah Real Estate Savannah Ga Homes For Sale Zillow Savannah Real Estate Savannah Chat Savannah Ga

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Florida Vs Georgia For Retirement Which Is Better 2020 Aging Greatly

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Tax Rates Gordon County Government

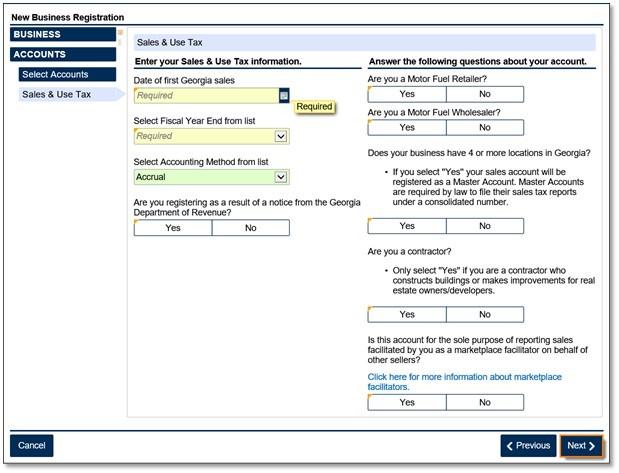

Marketplace Facilitators Georgia Department Of Revenue

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Georgia Sales Tax Small Business Guide Truic